Batam, located near Singapore, has become a hotspot for international trade and business investment. One key growth driver is the Import Pass (PPFTZ), a crucial document for companies operating within the Indonesia Free Trade Zone (FTZ).

Unlocking the potential of your investments in Batam starts with understanding the benefits of the import pass. This article will confidently guide you through the import pass and demonstrate how it can elevate your investment journey in the Batam FTZ.

Overview of PPFTZ

PPFTZ stands for the Free Trade Zone Import Pass. It permits companies to import goods and raw materials into Batam without paying import duties or taxes. This special pass simplifies logistics, reduces costs, and attracts foreign investors looking to expand their Southeast Asian operations.

Key benefits of PPFTZ for businesses

Why should companies consider this import pass? Beyond tax exemptions, it offers several advantages that make investing in Batam more profitable.

1. Cost Savings

Businesses enjoy exemptions from import duties and VAT, reducing operational expenses and boosting profit margins.

2. Easy Import Procedures

With PPFTZ Online, applications are processed quickly, cutting down on paperwork and customs delays.

3. Better Supply Chain Flow

Smooth import processes keep inventory steady and production on track, which is crucial for manufacturers.

4. Attractive To Foreign Investors

Batam’s FTZ and PPFTZ incentives make it an appealing destination for investing in Indonesia.

5. Flexible Forms

PPFTZ-01 and PPFTZ-03 suit different import needs, from raw materials to finished products.

Read more: Why should invest in Batam Free Trade Zone

Types of PPFTZ forms

| Forms | Purpose | Suitable for |

| PPFTZ-01 | Importing raw materials and components | Manufacture |

| PPFTZ-03 | Importing finished goods and non-production items | Distributors and trading companies |

To maximize the advantages of Batam’s Free Trade Zone, businesses must familiarize themselves with the different import pass forms available. Understanding the specific purpose of each form can greatly enhance operational efficiency and strategic planning.

1. PPFTZ-01

- Purpose: To import raw materials, components, and production inputs.

- Best For: Manufacturing companies that rely on foreign materials.

- Advantage: Streamlines the import process while ensuring tax exemptions.

2. PPFTZ-03

- Purpose: To import finished goods and non-production items.

- Best For: Distributors and trading companies bringing products for resale.

- Advantage: Allows faster clearance for commercial goods.

3. Other Supporting Forms

- PPFTZ Form: The general document submitted online to initiate the permit process.

- PPFTZ Piloting: A pilot scheme that tests new procedures for better efficiency.

Which form best meets your needs? Choosing the right one is essential to avoid delays and enhance your supply chain.

Read more: Top 10 Batam industrial parks for foreign investments.

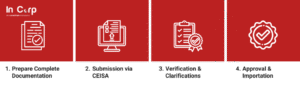

How to obtain a PPFTZ permit?

Applying for a PPFTZ permit is not just about filling out forms—it is about getting every detail right. The process is conducted through CEISA, Indonesia’s Customs-Excise Information System Automation, which is integrated with Batam Customs’ IBOSS platform.

While these systems digitize submissions, they enforce strict data accuracy and documentation standards.

1. Preparing Complete Documentation

Company licenses, import details, and trade documents must all meet Customs’ format and validity requirements.

2. Submitting via CEISA

Applications go through the CEISA portal, where errors or missing data can cause immediate rejection.

Batam Customs integrates its portal with its One Stop System (IBOSS) to streamline data flow and import pass processing.

3. Verification and Clarifications

Customs may request additional information or corrections before approving.

4. Approval and Importation

Once the permit is issued, businesses can import goods under the import pass scheme with FTZ benefits.

Even though the steps seem straightforward, many businesses encounter issues at the submission or verification stages due to compliance gaps. Expert guidance is often essential to keep the process smooth and avoid delays.

Read more: Navigating the landscape of Indonesian imports

Unlock import benefits in Batam with InCorp

Maximizing the benefits of PPFTZ goes beyond knowing the basics—it demands the right expertise to navigate Indonesia’s regulatory landscape easily.

As your trusted partner, InCorp Indonesia (an Ascentium Company) provides end-to-end support in obtaining import permits and delivering importer of record (IOR) services. This ensures your import operations in Batam remain seamless, efficient, and fully compliant with local laws, giving you the confidence to focus on your business.

Why Choose InCorp?

- Effortless Application: Avoid complexities and let experts handle the entire process.

- Compliant & Fast Solutions: Ensure your permits meet all legal requirements without delays.

- Tailored Support: Our tailored solutions keep your business running smoothly without an import permit.

Contact us today and start unlocking Batam’s import advantages with us! Let us embark on this journey together and see your business thrive in Batam’s FTZ.

Get in touch with us.

What you'll get

A prompt response to your inquiry

Knowledge for doing business from local experts

Ongoing support for your business

Disclaimer

The information is provided by PT. Cekindo Business International (“InCorp Indonesia/ we”) for general purpose only and we make no representations or warranties of any kind.

We do not act as an authorized government or non-government provider for official documents and services, which is issued by the Government of the Republic of Indonesia or its appointed officials. We do not promote any official government document or services of the Government of the Republic of Indonesia, including but not limited to, business identifiers, health and welfare assistance programs and benefits, unclaimed tax rebate, electronic travel visa and authorization, passports in this website.